Statement Of Complete Earnings Format, Examples

This is massive with insurance companies, who take premiums and invest those to make income for his or her holding firm. That Means, it’s a whole balance accrued over many years, like Cash and Cash Equivalents as another instance while OCI—displayed within the Statement of Comprehensive Income—is an annual figure, like Net Earnings. Any Web Income that’s not distributed through dividends (or share buybacks) to shareholders is reported as Retained Earnings. The influence of this new accounting rule impacts Net Revenue, Invested Capital, and ROIC calculations. A “gain” would cause the OCI account to extend (credit), while a “loss” would trigger the OCI account to decrease (debit).

Analysis And Interpretation

It is necessary to know the difference between the forms of complete earnings statements. One Other suggestion is that the OCI must be restricted, ought to undertake a narrow strategy. On this basis only bridging and mismatch positive aspects and losses should be included in OCI and be reclassified from fairness to SOPL.

The column of quantities that is closest to the words will include the amounts for the newest time frame. The columns furthest from the words will be the amounts from older durations of time. The older amounts provide a frame of reference for understanding the latest quantities. Under the accrual basis of accounting, revenues are recorded on the time of delivering the service or the merchandise, even when cash is not obtained at the time of delivery. This account is a non-operating or “other” expense for the cost of borrowed money or other credit score.

Best Practices For Decoding The Comprehensive Revenue Assertion Format

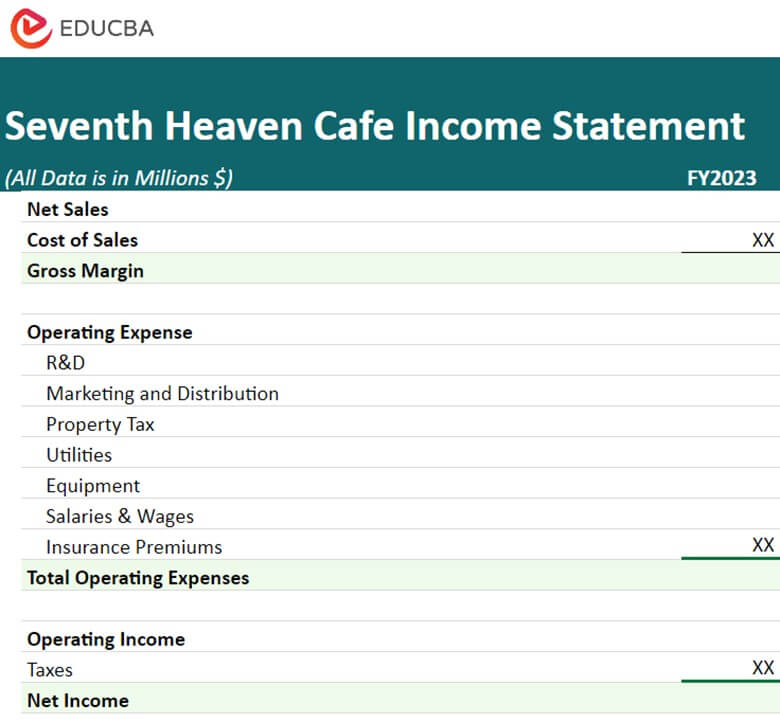

After the contribution margin is shown, the $6,000 of fastened costs and fixed bills that are immediately traceable to every product line are subtracted. Is it logical to match the costs from 20 years ago with the current yr revenues? Beneath we are going to discuss each part of the earnings statement beginning with the heading.

Only by recognising the efficient achieve or loss in OCI and permitting it to be reclassified from fairness to SOPL can customers to see the results of the hedging relationship. Different comprehensive earnings includes many adjustments that haven’t been realized yet. These are events which have occurred however haven’t been monetarily recorded within the accounting system because they haven’t been earned or incurred. You can think of it like adjusting the balance sheet accounts to their honest value. Since the income assertion only recognizes income and bills when they’re earned or incurred, many different sources of income and expenses are left off the assertion as a outcome of they haven’t been realized but. Investors and creditors still wish to know the way these different objects affect the equity accounts even if they are not included within the backside line.

Different Comprehensive Revenue (OCI) refers to financial transactions not yet realized but still impacting the company’s monetary place. By Way Of these points, we will appreciate the complexity and significance of the Assertion of Comprehensive Income in adhering to worldwide requirements and the insights gained from comparative analysis. By inspecting these aspects, stakeholders can higher perceive the monetary narratives of businesses and make extra informed choices. Understanding these variations is crucial for stakeholders who rely on the assertion of comprehensive earnings to make knowledgeable choices.

Rounding Of Quantities

Operating income is a vital line merchandise because it displays the company’s efficiency in its core enterprise operations and its capacity to generate profit from its primary actions. In the single-statement method, both the traditional https://www.simple-accounting.org/ revenue statement and the excellent revenue parts are combined into one steady assertion. This technique begins with the web earnings at the top, followed by the gadgets of other comprehensive revenue (OCI), and concludes with the whole complete income at the bottom. The single-statement strategy supplies a seamless move of knowledge, highlighting the connection between net revenue and comprehensive earnings. Observe that the statement for Toulon Ltd. (shown earlier in the chapter) combines net earnings and total complete income.

These investments are reported as a current asset if the investor’s intention is to sell the securities inside one yr. The quantity of other complete earnings is added/subtracted from the balance in the stockholders’ fairness account Accumulated Different Comprehensive Earnings. To illustrate, assume that XXL Company’s workplace and warehouse building was constructed 20 years in the past at a price of $750,000 and was estimated to have a useful life of 25 years with no salvage value. If the identical enterprise had been organized as an everyday company and the owner/stockholder obtained a wage of $80,000, the income statement will report a net income of $20,000. The purpose is that the $80,000 salary might be listed on the corporation’s revenue assertion as salary expense.

Comprehensive Earnings encompasses several components that replicate the adjustments in fairness not captured in the web income. Understanding these elements is essential for analyzing a company’s general financial performance and position. The main components embrace unrealized positive aspects and losses, foreign forex translation adjustments, and pension plan features and losses. Foreign currency translation changes are differences that come up when changing the financial statements of a foreign subsidiary into the mother or father company’s reporting currency.

- The balance sheet stories the belongings, liabilities, and owner’s (stockholders’) equity at a specific cut-off date, such as December 31.

- This allocation process could be cumbersome and would require extra time, effort, and skilled judgment.

- A revaluation surplus on a monetary asset classified as FVTOCI is a good instance of a bridging acquire.

- International standards like IFRS and GAAP have been established to ensure that financial statements are constant, reliable, and comparable throughout worldwide borders.

Sustaining the gross profit percentages is usually difficult because of pricing pressure from other firms, greater costs from suppliers, general inflation, and extra. When an entity chooses an aggregated presentation in the statement of complete income, the amounts for reclassification changes and present year achieve or loss are introduced within the notes. Mastering the great earnings statement format is essential for companies aiming for monetary transparency, regulatory compliance, and funding growth. ✔ Web revenue reflects short-term profitability, while comprehensive income statement format provides a long-term financial perspective—vital for buyers and strategic planning.